While 2013 proved to be a great year for the housing market recovery in the Greater Phoenix Metro Area, with the median sales price increasing 20 percent, most of the gain was in the first half of the year, and December ended with the same median sales price as July.

The slower pace has continued for 2014. Typically, the spring season almost always is the strongest part of our year for demand. However, this year has seen a decline.

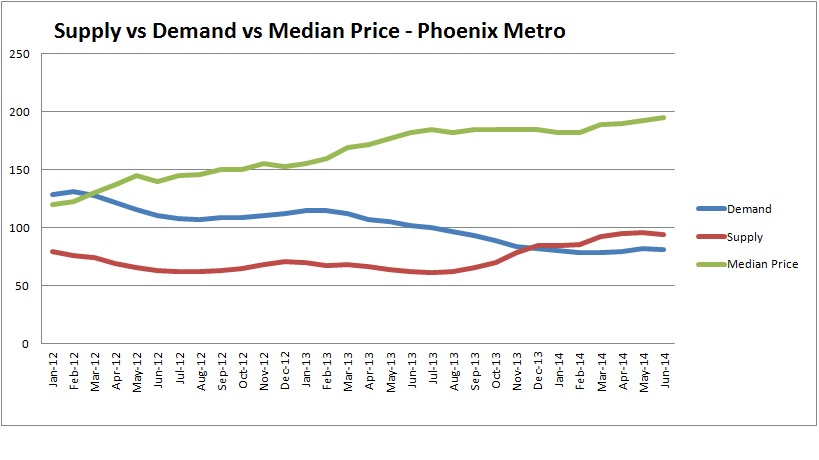

Supply Versus Demand – Greater Phoenix Metro Area

In the first half of 2013, we were in a seller’s market, with a chronic shortage of supply and higher demand, which created multiple offers and surging home prices like we hadn’t seen in years. In mid-2013, we started seeing the supply begin to increase each month, while demand decreased 21.4 percent. The housing market has now shifted from being chronically short of supply and a seller’s market, to a much more balanced market, and now is weighing slightly toward the buyer.

Fall Season in Arizona

Unlike other parts of the country, Arizona’s housing market gets another boost in the fall, with second home buyers. With our soaring temperatures, Arizona’s summer months are the slow season. We hope to see sales tick up again starting in September.

Lenders and Boomerang Buyers Could Help Demand

Lenders and so-called boomerang buyers could be key in helping solve the demand problem, according to Michael Orr, the director of Arizona State University’s Center for Real Estate Theory and Practice.

Lenders, also feeling the brunt of weak demand, have been hurting for business in recent months, with new mortgage applications falling to a 14-year low, according to the Mortgage Bankers Association.

Orr suggested this might finally push lenders into easing their ultra-tight lending restrictions, which have been exacerbating the demand problem.

Phoenix was one of the cities hardest hit in the housing crisis for short sales and foreclosures, which also means we will have a greater increase in demand from boomerang buyers over the next few years. These are the buyers who lost their homes to foreclosure or short sale, and have waited the required time period to be able to qualify for a new mortgage again.

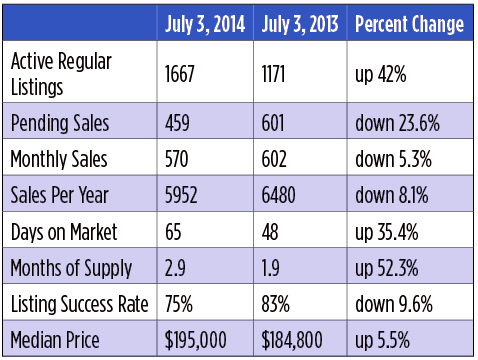

Statistics for Mesa Regular Sales

(Only single-family detached dwelling types are included)

Changes to Short Sale Waiting Period for New Loans

In June, Fannie Mae announced that as of Aug. 16 and going forward, they will no longer allow a borrower to qualify for a conventional loan two years after a short sale unless they can document the fact their short sale was caused by an extenuating circumstance (see full article for definition of extenuating circumstance). Instead, a borrower must be four years beyond their short sale in order to qualify for a conventional loan. Visit my website for the full article and all the new guidelines.

Lorraine Ryall is a multimillion dollar producer and recipient of the Coldwell Banker International President’s Circle Award. For more information, call (602) 571-6799, or visit her website at www.Homes2SellAZ.com.

Ryland Homes Update/Correction

After speaking with the president of Ryland Homes Phoenix Division, he confirmed this will be a gated community and does offer some single-story homes. The exterior/elevation may be different from other Ryland homes, as they have been designed to blend in with the Las Sendas community. Although no decision has been reached yet, it is expected this community will be incorporated into the Las Sendas homeowners association.