The seller’s market in Phoenix has continued to strengthen into May, which is typically the most active month for new contract activity every year.

The supply of homes for sale in the MLS is now 22 percent below historically normal levels, while demand is 2 percent above normal. This places the Cromford Market Index (CMI) at 129.3, indicating a strong and growing seller advantage.

The lack of choice for buyers is giving sellers an advantage in negotiation, and causing sales prices to rise in many areas, but not as sharply as you might think for the majority of homes. The primary lack of supply is in single family homes below $200,000. However, it’s starting to decline further in the $200,000 to $300,000 range, as well. This has been good for condominium and townhouse sales, which have been supplementing supply in these price ranges and seeing increased buyer interest.

QUARTERLY MEDIAN SALES PRICE RISING

In the Phoenix metro area, 50 percent of all sales are below $205,000 so far in the second quarter of 2015. That is up 3.3 percent from the first quarter measurement of $198,500. Historically, the median price for this quarter is comparable to the second quarter of 2008 ($207,000) and between the first and second quarters of 2005 ($197,000 to $238,000).

Our market today is nothing like the spike of 2005 or the fall of 2008, however. Supply was much lower, and demand was much higher in 2005, which put the CMI at a record high of 312 compared to our current value of 129.

In 2008, supply was much higher and demand much lower than today, with a catastrophic and near-record low CMI of 30. The farther away the CMI gets from 100, the more dramatically prices will respond in either direction. Sale prices are expected to continue rising in the short term, but at a more gradual and sustainable rate over time.

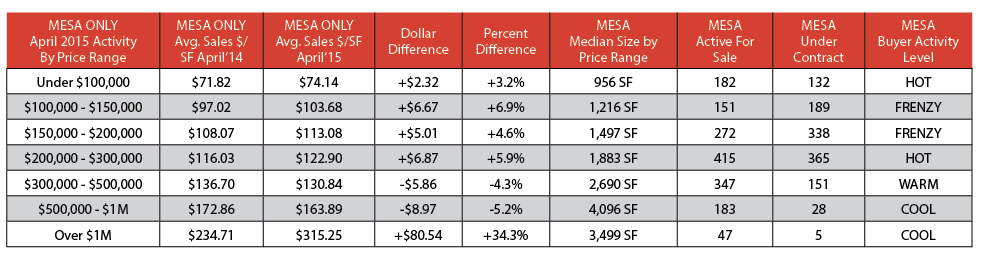

Not surprisingly, the highest percentage increases in sales price per square foot are in the lowest price ranges. Working from an already small base means even similar dollar differences will produce varying percentages across price ranges. The price range that stands out the most is $100,000 to $150,000, with a whopping $7.33 per square foot increase and 8.4 percent difference from last year.

While the dollar increase in the over $1 million price range also is eye-catching, it’s not caused by a lack of supply. In fact, there are a wide variety of luxury products available, and square footage is not a primary factor in price. Demand is up this year, and buyers have significant choice in products, such as high rise condominiums, horse properties, mountaintop lots and sprawling estates. Because of the varying square footage of these different luxury products, combined with a comparatively small dataset of sales scattered throughout the Valley, the monthly sales price per square foot in this price range can be erratic, with great fluctuations from one month to the next.

HOW MESA COMPARES TO THE OVERALL MARKET

The market in Mesa is mirroring the overall market under $300,000, and is cooler than the overall market over $300,000. Buyers over $300,000 are getting more home for their money in Mesa versus the Phoenix metropolitan area as a whole.

On the lower end, there are literally more properties under contract than active for sale between $100,000 and $200,000, creating a frenzy situation for buyers in competition with each other for smaller homes. There isn’t much relief if buyers go up or down a notch in price as it just goes from frenzy to extremely hot.

Appraisals have been a key factor in maintaining a calmer appreciation rate despite the frenetic atmosphere. The majority of buyers require a loan, and thus an appraisal. Those who have already gone through a short sale or foreclosure in the past seven years are less willing or able to pay significantly over appraisal than they were in more confident times.

For additional information, call Ron Brown at (602) 618-9512, or visit the websites at TrailsAndPaths.com or Coldwell Banker Trails and Paths. Serving the East Valley for the past 16 years, the office is located in The Village at Las Sendas, at Power and McDowell roads.