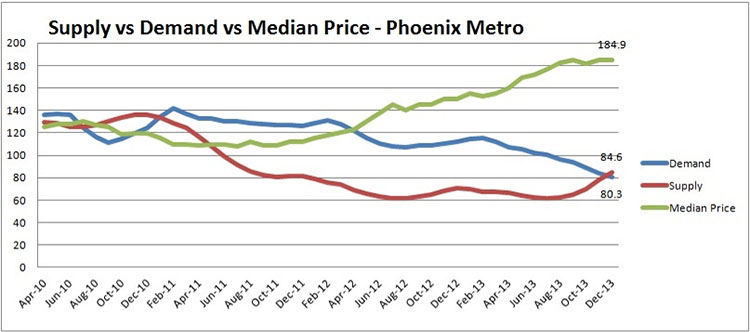

With the close of 2013, we can see how our housing market has continued to make a strong recovery, with the median sale price up 20.9 percent year-over-year.

The most surprising factor is all the gains took place in the first half of 2013, with the median sales price ending in December at $185,000, which was the same price as July.

Inventory

The year 2013 began as a seller’s market, with more demand than supply, which remained constant until June. Starting 2014, the total inventory is at 25,360, which is a 20 percent increase year-over-year. At the same time, demand has dropped, and we now have a balanced market, with supply and demand being pretty equal.

Interest Rates

The 30-year fixed rate started 2013 at 3.34 percent, while 2014 has started at 4.53 percent. The increase in rates took place between May and July 2013, and has stayed pretty consistent since then. While this is an increase, we still are at historically low interest rates.

Distressed Inventory and Sales

With our housing recovery, come fewer homeowners facing foreclosure. In January 2013, there were 11,635 notices of trustee sales, and that number has decreased to 5,974 in January 2014. At the beginning of 2013, distressed sales, which include both foreclosures and short sales, accounted for 33.8 percent of sales. As of December 2013, that number had decreased to 17.1 percent.

Look Ahead for 2014

We have begun 2014 with a 41 percent drop in pending sales. There are several factors contributing to the lower number, including far fewer short sales, which take longer to close, and remain in pending for months.

Our market is no longer inviting to the bargain hunters and investors, with far fewer distressed properties and increasing prices, therefore, taking out a significant number of buyers/investors we had in previous years. Even with those added factors, the fact remains the market has changed, and, for the first time since January 2011, we are in a balanced market, with supply and demand pretty much equal.

With a balanced market, prices are not expected to increase anywhere near the rate of the previous year, but the market should remain pretty stable. The key over the next few months is going to be supply verses demand. Too much supply, and it becomes a buyer’s market. More demand than supply, and it is a seller’s market. We are coming into our peak buying season, and with interest rates still at record lows, and home prices expected to increase, even if at a much slower pace, it is a great time to buy.

For the complete article and charts showing monthly statistics, please visit my Web site blog page at www.Homes2SellAZ.com.

The Mortgage Debt Relief Act Has Expired

As expected, The Mortgage Debt Relief Act of 2007 has not been extended and no longer applies. While this sounds like bad news, it really doesn’t apply to about 90 percent of mortgages here in Arizona. Taxes do not apply on nonrecourse loans. Arizona is an Anti-Deficiency state, which means the lender cannot sue the homeowner after a foreclosure or short sale. This makes the mortgage nonrecourse, and, therefore, not liable for taxes. This applies to purchase money, and the loan must meet certain criteria, which 90 percent of mortgages in Arizona do. Call me today to find out if your loan qualifies. You also can call for a free, no obligation consultation.

Lorraine Ryall is a multi-million dollar producer and recipient of the Coldwell Banker International President’s Circle Award. For more information, call (602) 571-6799, or visit her Web site at www.Homes2SellAZ.com.