There has continued to be a great deal of discussion in the media about where the real estate market is headed in 2011.

There has continued to be a great deal of discussion in the media about where the real estate market is headed in 2011.

While the stock market ticked up slowly and steadily in 2010, the real estate market just didn’t mirror that trend. However, it does seem as if home prices have leveled out a bit, and it seems as if the foreclosure rates also have stabilized with the improving economy.

The newer three-bedroom, two-bath homes in Queen Creek, which people were picking up at auction for $50,000 cash in 2009 and early 2010, are gone. Those insane deals have passed

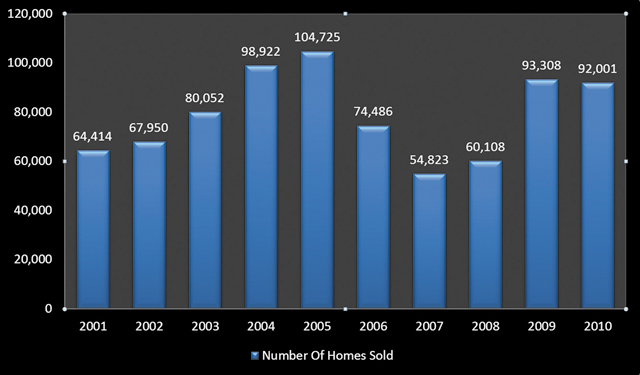

The number of units sold shows there is still strong market activity, and our current inventory in the Arizona Regional MLS is just 37,107 properties. During the worst point of 2007, that inventory had swelled to more than 58,000 homes on the market.

In a recent article in Forbes Magazine, Brian Wesbury, chief economist at First Trust Advisors, told Steve Forbes, “If Americans don’t start focusing on building new houses, the market will have a much bigger problem on its hands. We need one and a half million houses per year just to keep up with population growth, and then if you throw in, you know, fires and tear-downs and just worn-out properties, we need 1.6 million or more per year. Right now, we’re down to about six and a half, seven months’ inventory whether you look at new homes or existing homes.”

So what does all this mean? This is the time to help your kids or grandkids buy their first home. This is the time to buy a retirement home. This is the time to upgrade to a bigger house (especially if you are moving up from the $100,000-$250,000 range).

This also is the time to purchase rental income property. I have sold several homes in Las Sendas and Red Mountain Ranch to investors over the last few months, and each one of those homes was rented within three weeks. If you would like to better understand how rental income property works, I would be happy to meet with you and run the numbers to see if owning a rental might work for you.

I wish I could tell you all of our property values would go back to their 2005 values next month. While I can’t promise any miracles, there does seem to be hope on the horizon, including the improving economy, great values, good interest rates and a manageable number of homes on the market.

I am in trenches of the real estate world every day, and, at certain price points, we are seeing the same intensity of activity we saw in 2005. Homes priced aggressively are getting multiple offers, and the banks are motivated to move their inventory of homes. Once the number of bank-owned homes is reduced to a manageable level, I believe we will start to see an increase in values. While this will not happen overnight, it will happen.

John Karadsheh is a licensed REALTOR