Ron Brown

The Phoenix real estate market really has taken off during the month of February across nearly every price range.

Buyer season in Phoenix lasts typically from March through the end of June every year. We watch this by looking at the number of listings under contract as an indicator for future sales. As of March 7, Metro Phoenix has 12.6 percent more listings under contract than it did this week last year, and the trend is similar to that of 2009. In 2009, foreclosures and short sales had 76 percent market share in residential sales. This year, foreclosures and short sales have less than 10 percent market share of residential sales. This is very good news for stable property values. In a fully recovered market, distressed properties should make up only 3 percent of residential sales through the Multiple Listing Service. So, we are in the final stretch.

DEMAND

While 12.6 percent more listings under contract may not seem like a big deal to some, it is important to note it took our market another six weeks to achieve this level in 2014, and that was the peak of the market. While it is extremely difficult to predict the exact number of contracts to be written, history tells us it is not unreasonable to expect this number to grow to its highest between April and May. That is exciting for sellers today. Note the breakdown of the increases in listings under contract by price range.

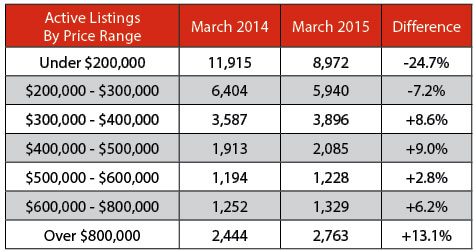

SUPPLY

While it’s exciting to see big increases in pending sales by price range, the level of active listings will greatly impact a client’s experience while buying or selling. Buyers gain advantage when there are more listings on the market in relation to shoppers. Sellers gain advantage when there are fewer listings on the market. Under $200,000, the large drop in supply in relation to the small increase in demand is resulting in a frenzy environment for buyers. Conversely, over $800,000, even though there is consistent demand, sellers have over 13 percent more competitors, giving buyers more advantage during contract negotiations.

INFLUENCES

A pair of influences in demand has come from changes in both Federal Housing Administration (FHA) and conventional financing. This past January, it was announced FHA financing would lower monthly mortgage insurance premiums, which became effective on Jan. 26. FHA, which lends up to $271,050, reduced the cost of its mortgage insurance premiums, resulting in a monthly savings on the mortgage payment as high as $100 per month. That is enough of a difference to help some consumers achieve the required debt-to-income ratios to qualify under FHA, thus increasing the buyer pool under $280,000. Conventional lenders also announced a 3 percent down payment program, which has boosted sales more than $280,000. Prior to this change, consumers needed at least 5 percent down to purchase property more than $280,000. This change has moved up the timeline for many buyers who would have needed more time to accumulate the necessary cash.

The main influence, however, has been the return of those previous homeowners who suffered a foreclosure or short sale years ago. After waiting the mandatory seven years after foreclosure, and four years after short sale, tens of thousands of people will have these blemishes removed from their individual credit reports this year. Their return is just one more step in the recovery process in Phoenix.

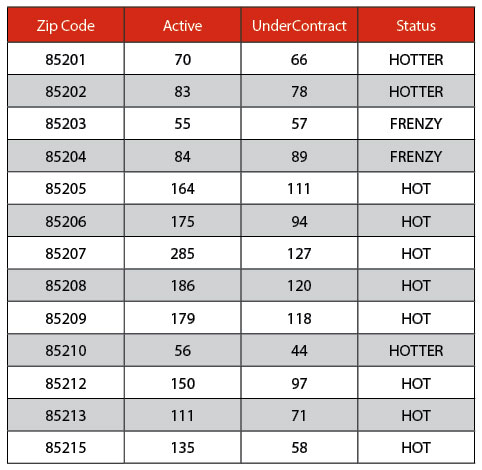

MESA’S HOTTEST ZIP CODES AND PROJECTED PRICE RESPONSES

The market in Mesa is closely mirroring the rest of the market. Those zip codes with lower list prices are in frenzy, while the upper end is cooler. Selling quickly requires supply to be low in comparison to demand. With that in mind, right now is the best time to list in order to get the most buyer activity. However, in terms of potential price appreciation, with fewer cash transactions, and more buyers obtaining loans, appraisal contingencies may keep prices at a more sustainable rate than the market has seen in the past.

For additional information, call Ron Brown at (602) 618-9512, or visit the websites at www.TrailsAndPaths.com or www.LasSendasColdwellBanker.com. Coldwell Banker Trails and Paths, serving the East Valley for the past 16 years, is located in The Village at Las Sendas.