The top question on everyone’s mind right now is How is the housing market?

With so much talk about how the economy will be affected by COVID-19, everyone is wondering will home sales and home prices drop and if so by how much?

In March, when COVID-19 was declared a pandemic, we saw the first signs of how this crisis could impact the market as potential sellers decided not to list and some current sellers cancelled their listings. By early April, we saw more sales than normal fall out of escrow for a number of different reasons but most related to the crisis in one way or another. With the stay-at-home order, closure of schools and non-essential businesses, and fearful news reports, the market started hitting the pause button.

However, by the middle of April, things already began to turn around as people still needed to buy and sell homes. We were still having showings, just a lot fewer, no looky loos but buyers who needed to buy, and homes were going under contract.

By the end of April, people were getting some confidence back and in May it was like the flood gates opened — sellers were ready to list their homes again and buyers were ready to buy, and move quickly.

We couldn’t have picked a better state to be in while we had the stay at home order. Suddenly, we had extra time to get out and explore more of our amazing desert landscape, hike, bike ride and spend time with our family. Not only were we in the best state for staying-at-home and closures, but Arizona was in the best position to weather the storm.

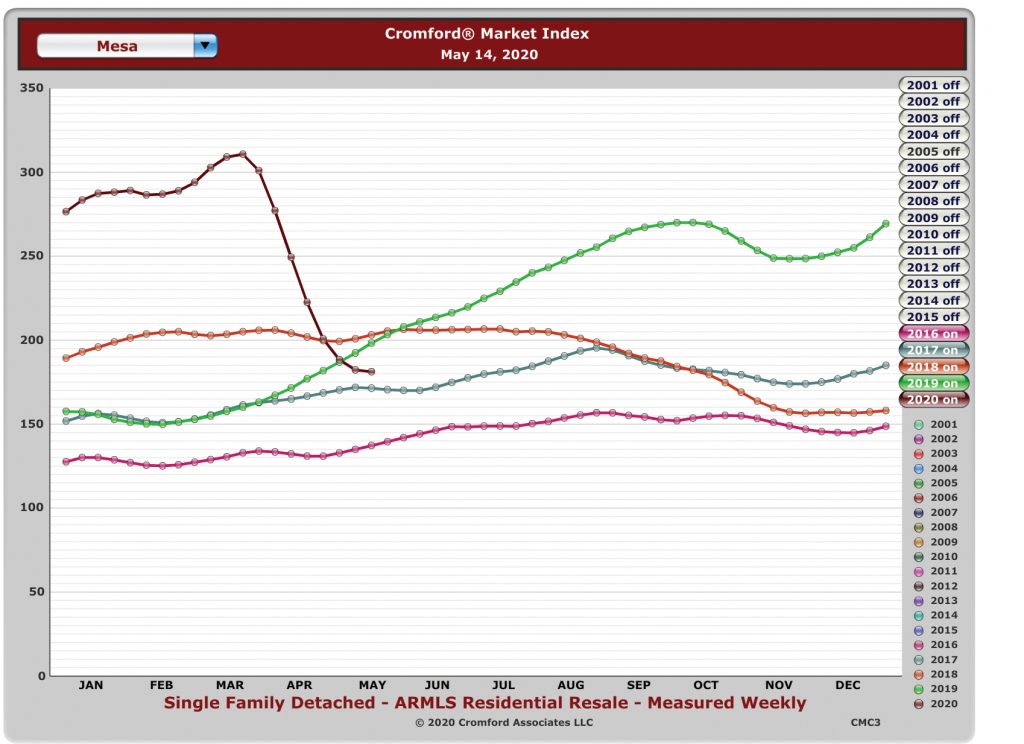

The Cromford Market Index™ (CMI) is a single value that indicates the balance of the residential resale market. Values below 100 indicate a market that favors buyers. Values above 100 indicate a market that favors sellers. A value of 100 is equally balanced.

Supply and demand are one of the main factors that determines home prices, and 2019 saw that spread widen with lower inventory and higher demand. The Cromford Market Index (CMI) increased by 78 percent in 2019 and the trend continued into 2020. In March 2020, there was such a shortage of inventory that a listing would have multiple offers on the first day of being on the market. Buyers were having to bid above the asking price, buy as is or waive the appraisal contingency just to get their offer considered. It was a dangerous position for the housing market to be in, to be so unbalanced and prices continuing to be inflated, but it was a great position to be in heading into the COVID-19 crisis and gave us a great cushion.

The housing market could afford to lose a lot of demand and gain a lot of supply and still be in a strong market, which is exactly what happened. As you can see from the chart below, the index did a major drop when everyone paused in March/April, but is leveling out again in May. Even with that significant drop we are still in a strong sellers’ market with the index at 181.

The chart below shows the CMI for Mesa for the past 4 years. 2019 rallied with far more demand and even less supply. By the time we headed into March 2020, the Cromford Market Index was at 310, which is 210 above a balanced market, which is 100.

So back to the question? Will sales and home values drop and if so by how much? Homes in the low to mid-price range have not been negatively impacted and this market remains strong or even stronger than it was before. The luxury market on the other hand has seen a slight decline in home sales as this is usually the market that is impacted first.

Home prices are down by 3.5 percent for May compared to April for the entire Phoenix metro area. However, the primary reason for lower average pricing is the absence of the usual number of high-end homes. This became more extreme in the last four weeks as the regular market started to build in volume while the market over $1 million did not.

Overall home prices are unlikely to fall without a glut of homes for sale, and that is something that does not look likely at this point. Almost no foreclosures took place in May and many borrowers took advantage of mortgage forbearance programs. The greatest risk to the market is in what happens to lenders and loan servicers over the next 12 months with all the loans in forbearance, and how unemployment will impact the economy.

Currently, I have seven homes listed with a price range of $270,000 to $1,450,000 and all are under contract. The last three were sold in the first two days of being on the market and two of them were sold above asking price.

I have more listings coming on the market and expect them to be under contract within the first week or two as well. At this moment, I anticipate the market will be very strong through the summer and into the early fall.

If you are thinking of buying or selling, or would like more information on the housing market, please don’t hesitate to contact me at (602) 571-6799, or email Lorraine@Homes2SellAZ.com.