Higher interest rates are one of the top reasons why the market has done a sudden slow down since May.

The current real estate market is a lot different than it was a year ago, when we had record low inventory, homes selling in one day, and bidding wars. It was a seller’s market and sellers had all the control.

Then the sudden jump in interest rates followed by continued rate increases made buyers either put their decision to buy on hold or, for some, were priced out of the market altogether.

Although technically we are still in a seller’s market, it feels more like a buyers’ market and buyers are now in the driver’s seat. Buyers are asking for repairs, which was almost nonexistent in the seller’s market, when everyone was buying as-is. Buyers can now get their offer accepted when it is contingent on the sale of their current home, but the biggest change and something we haven’t seen in the last year or two is buyers are asking for sellers’ concessions.

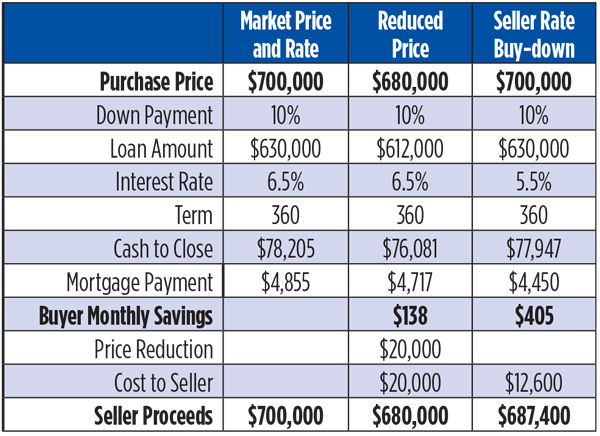

Many buyers are tempted to ask for purchase price reductions. While this feels like a win, it might be better to ask the seller for that money in a concession. Seller’s concessions can be used to pay for closing costs and to buy down the buyer’s rate.

Sellers are seeing their homes sit on the market and will do price reductions to try and get their home sold. Offering sellers concessions that the buyer can use to buy down their rate — will not only entice buyers but will net the seller more money as well.

WHAT IS A SELLER-PAID RATE BUYDOWN

A rate buydown is a way for a buyer to obtain a lower interest rate by paying discount points at closing. Discount points are a one-time fee paid upfront that will reduce the interest rate for the loan term.

HERE IS AN EXAMPLE OF HOW DISCOUNT POINTS WORK

Let’s say you are looking to purchase a single-family home for $700,000 and are putting 20 percent down. This would give you a loan amount of $560,000. The interest rate is 7 percent on a 30-year fixed-rate mortgage.

If you want or need a lower interest rate to lower your monthly payment, you have to buy down the rate, which means paying a lump sum up-front (discount point), that will reduce your rate. To buy down the rate by 0.5 percent, it will cost you one percent of the loan amount — so in this scenario, one percent is $5,600, that would be added to your closing costs, and your interest rate would drop from 7.0 to 6.5 percent and save you $186.11 per month.

A PRICE REDUCTION VERSUS A BUYDOWN

If you were going to offer $10,000 below the seller’s list price, in the example above, that would only lower the payment by $63.21. If you were to put that same $10,000 to work in points and buy down the rate, it would lower the monthly payment by $271.57. From a monthly payment perspective, asking for the concession and paying full price makes more sense than getting a $10,000 lower purchase price and paying the full interest rate.

THE ADVANTAGES OF A SELLER-PAID RATE BUYDOWN

- Offering a below-market interest rate for the property will entice more buyers

- It nets the seller more money than a price reduction

- Saves the buyer money on their monthly mortgage payment for the term of the loan

- Helps hold home values for the area by not doing a price reduction

- Avoids the stigma of a price reduction

If you would like more information on how a sellerpaid rate buydown may be a great option for you or how it works either as a buyer or seller, please don’t hesitate to contact me at (602) 571-6799.

Lorraine is a Multi-Million Dollar producing agent, has been a full-time Realtor for over 13 years, is an Associate Broker of KOR Properties, a Certified Negotiation Specialist, and is on the Professional Standards Board. You can reach Lorraine at (602) 571-6799.