Market Update

If you are purchasing a home and have been watching the market, you may have noticed quite a few price reductions on currently listed homes in the past month.

August and the first half of September have seen home prices decline from the previous month. This is partly due to the cyclical nature of the market in Arizona, where the summer months are always slower, but also due to the increase in mortgage rates. Supply has increased by 1.1 percent, and demand decreased 3.7 percent. The forecast for October is for prices to increase as the market starts to pick up again, and the current pending sales list price is

2.5 percent higher than this time last month. However, the new announcement by the Feds will probably push prices even higher than projected.

Mortgage Rates drop after the Federal Reserve’s Announcement

With the announcement that the Feds are not going to start tapering off on purchasing treasuries and mortgage-backed securities it purchases each month, mortgage rates immediately started to drop. With this second chance on lower interest rates, buyers are going to be jumping back in as quickly as they can to lock in their rate before anything changes and rates start to increase again.

For sellers, with this increase in demand, and still record low inventory, it’s a perfect seller’s market. Higher demand and low inventory means multiple offers and higher prices. But who knows how long this reprieve will last. Should the economy start picking up steam again, chances are the tapering off will resurface, driving rates back up. So, now is the best time to make your move.

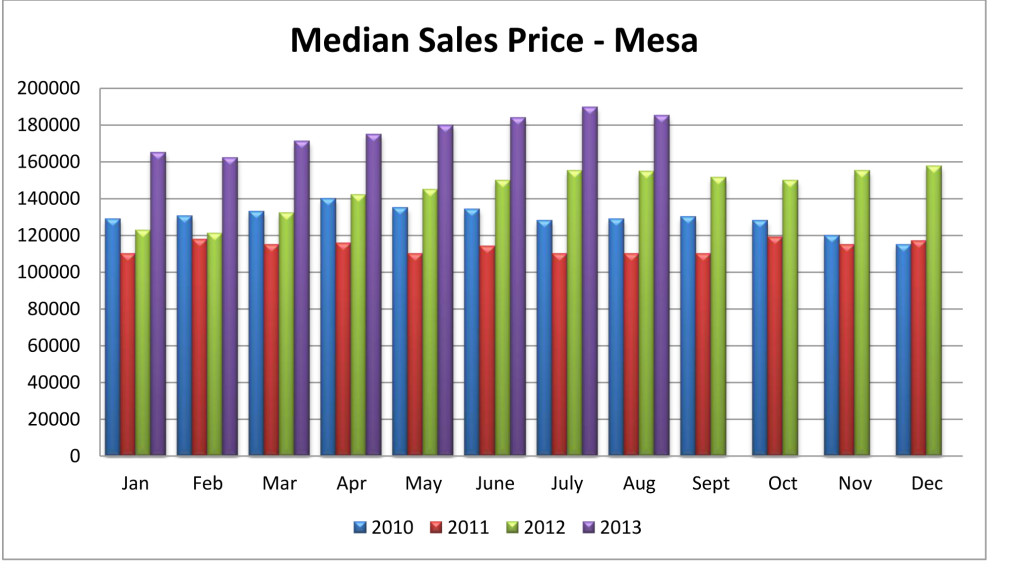

Charts and Statistics

As the charts last month were very small, I am now only using one chart each month in my articles, but the others can be viewed on my Web site at www.Homes2SellAZ.com/blog, along with a current monthly market update video.

Call me at (602) 571-6799, or e-mail to Lorraine@Homes2SellAZ.com. Visit my Web site at www.Homes2SellAZ.com.

Get an Instant Home Value Report at www.InstantHomeValueAZ.com.