With the change in the housing market, short sale and foreclosure are no longer foreign words to us.

With the change in the housing market, short sale and foreclosure are no longer foreign words to us.

For homeowners who are upside down on their mortgage, behind on their payments or facing foreclosure, the question is, “Which option is better for me?” While each situation is different, a short sale is nearly always the best option. Here is a brief overview of both, and you can find more detailed information on my Web site.

Short Sale

A short sale is a process by which the bank agrees to sell the home for less than the amount owed. It is usually far less damaging on your credit compared to a foreclosure. It’s actually the late payments that ding your credit more than the short sale itself. There are now more options available whereby the homeowner can stay current while doing the short sale. This will lessen the credit impact, and may allow you to purchase a new home the day after the short sale closes.

If there is a second mortgage or home equity line of credit (HELOC), a short sale is the only option where the second can be negotiated at the same time, and you can get the deficiency waived. This means the banks cannot pursue you for the balance of the loan. This is not an option in a foreclosure.

For homeowners who have security clearance for their employment, a short sale does not usually affect it. If you are in the military, there are some great programs, which will immediately qualify you for a short sale.

The banks want to do short sales rather than foreclosures, and there are many programs offering homeowners anywhere from $3,000 up to $30,000 to do a short sale.

There is no charge to the homeowner to do a short sale because the lender pays all the fees, including the Realtor and title fees.

Foreclosure

A foreclosure usually is the least favorable option, with the most severe impact on your credit. It is a legal proceeding in a court of law, and it is a judgment against you. The foreclosure remains on your credit for seven years. Getting credit, not only for a new mortgage, but also a car loan, credit card or other credit, can be a lot harder or even can be unavailable for a lot longer when a foreclosure is on your record.

Employers may refer to your credit score as part of their hiring process, and a foreclosure can hinder your chances of getting a job offer. If you have any other loans, such as a HELOC, they are not released in a foreclosure.

Contact me today for more information on short sales and foreclosures or for a free confidential consultation. You can

call my cell at (602) 571-6799, or send an e-mail to Lorraine@ArizonaShortSaleToday.com. Visit my Web site at www.ArizonaShortSaleToday.com.

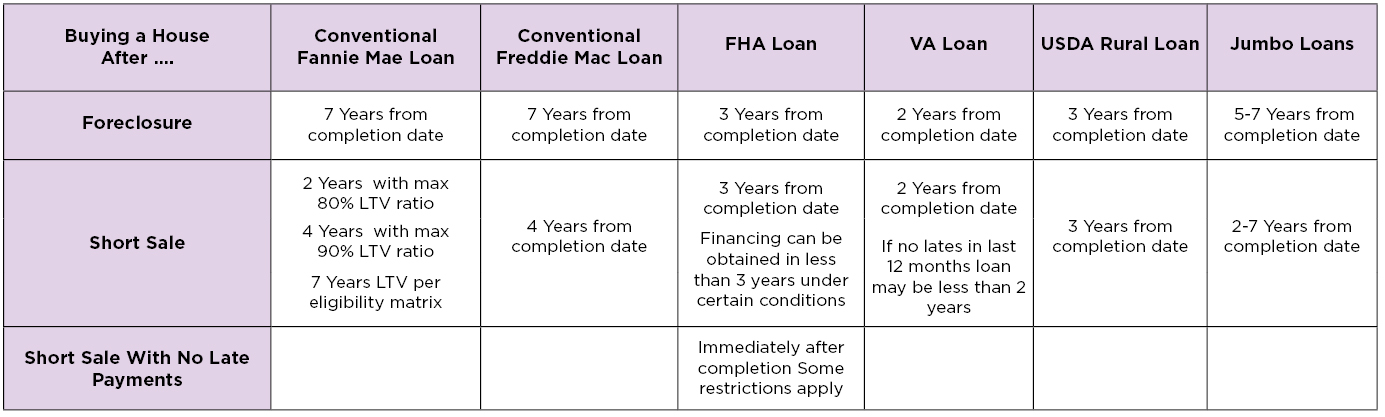

Buying a home after foreclosure or short sale waiting period chart: