The number of listings under contract has continued to improve, and has reached nearly 13,000 by mid-April.

This number is 9 percent higher than April 2014, and signifies a continuance of the Phoenix real estate recovery. As rents have continued to rise in the single-family home segment, some renters are discovering they are paying more in monthly rent than a mortgage payment on a similar or even larger home. This, combined with lower down payment and mortgage insurance requirements, has been making homeownership a viable solution to lock in monthly expenses.

Seeing more buyers shopping is good news for sellers today, especially those under $300,000. With fewer new listings coming on the market to replenish those that have sold, there is less competition for sellers to consider. This puts sellers in a better position when it comes time to negotiate, and increases their chances of a successful close.

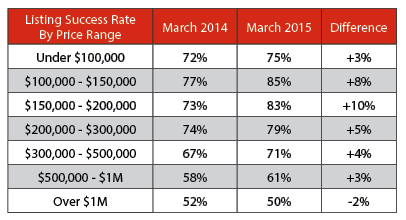

MORE LISTINGS SUCCESSFULLY CLOSING

An active listing isn’t considered failed or successful until it cancels/expires or closes. An increasing listing success rate means, of the listings coming off of active status, fewer are cancelling or expiring, while more are closing. Not surprisingly, the $100,000 to $200,000 price range is experiencing the two highest success rates, while the higher price ranges are more moderate in their improvements. The luxury market over $1,000,000 has not lost any demand compared to last year, but they have increased competition in new listings, which has diminished their negotiating advantage.

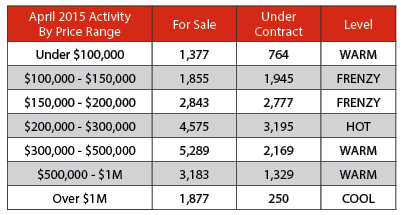

SUPPLY AND DEMAND

The under $100,000 market has very little for sale, and 78 percent of all the supply is townhouses and condominiums. Single-family homes under $100,000 are in a frenzy environment similar to the $100,000 to $200,000 price range. Sales under $300,000 represent 77 percent of all sales activity in the Phoenix metropolitan area. To have such a significant percentage of the market in short supply and good demand sets up a positive price appreciation projection for the next year. The over $300,000 is still doing well. It may not be as hot as the lower prices, but there is still stronger contract activity in 2015 than there was during the chilly 2014 market.

The under $100,000 market has very little for sale, and 78 percent of all the supply is townhouses and condominiums. Single-family homes under $100,000 are in a frenzy environment similar to the $100,000 to $200,000 price range. Sales under $300,000 represent 77 percent of all sales activity in the Phoenix metropolitan area. To have such a significant percentage of the market in short supply and good demand sets up a positive price appreciation projection for the next year. The over $300,000 is still doing well. It may not be as hot as the lower prices, but there is still stronger contract activity in 2015 than there was during the chilly 2014 market.

INFLUENCES

The main influence has been the return of those previous homeowners who suffered a foreclosure or short sale years ago. After waiting the mandatory seven years after foreclosure and four years after short sale, tens of thousands of people will have these blemishes removed from their credit reports in 2015. Their return is just one more step in the recovery process in Phoenix. These consumers are not restricted to the lower price ranges. They span the entire market and will affect demand overall.

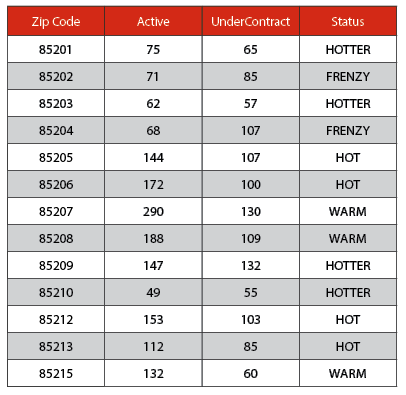

MESA’S HOTTEST ZIP CODES AND PROJECTED PRICE RESPONSES

MESA’S HOTTEST ZIP CODES AND PROJECTED PRICE RESPONSES

The market in Mesa is closely mirroring the rest of the market. Those zip codes with lower list prices are in frenzy, while the upper end is cooler. Selling quickly requires supply to be low in comparison to demand. With that in mind, right now is the best time to list in order to get the most buyer activity. However, in terms of potential price appreciation, with fewer cash transactions and more buyers obtaining loans, appraisal contingencies may keep prices at a more sustainable rate than the market has seen in the past.

For additional information, call Ron Brown at (602) 618-9512, or visit the websites at www.TrailsAndPaths.com or www.LasSendasColdwellBanker.com. Coldwell Banker Trails and Paths, serving the East Valley for the past 16 years, is located in The Village at Las Sendas.